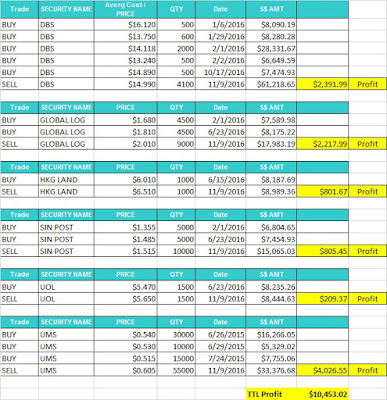

You are Not so SMART ! Why I still not happy with $10,453.02 profit I have made recently

As investor who has gone through many business and market cycles in the past 19 years of investing, Yes! I still made a terrible mistake and succumbed to our own biases in trying to time the market. Although we still can feel some ripples effect from US Presidential Election from time to time but I think its impact on the stock market has mostly subsided, as we could see that Dow Jones Index rebounded strongly after that and keep trading at record high recently.