How Much Luck in Investing Success? My Experience in 2008/09

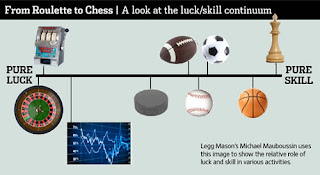

image credit to mymoneyblog.com We all know well that the market is efficient (most of the time) and much active management fund outperform because of “luck “ and not skill. You may find out more about this topic in my previous blog on Success in Investing: Skill or Luck? ( here ). As most of the investment professional think, it is hard to admit that luck plays as significant a role as skill in their investment success. That's not to say skill is unimportant but betting on continued success doesn't work well in investing as in other fields.