Patterns , Patterns , Patterns !

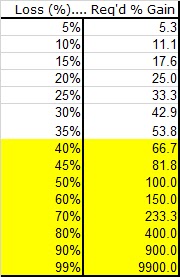

Did you see any patterns in below charts /images? Can you relate this to Investing? image credit to amazon.com.cg image credit to home.com image credit to amazon.com .sg

"The stock market is a device for transferring money from the impatient to the patient " by Warren Buffet .