Portfolio Construction : To Diversify or Not to Diversify ?

As investors, when we think about Risk-Reward

analysis, the first thing pops up in our mind automatically will be the word “

diversification”.

This is what been mentioned in Investopedia

about the importance of Diversification :

"Diversification is a technique

that reduces risk by allocating investments among various

financial instruments, industries and other categories. It aims to

maximize return by investing in different areas that would each

react differently to the same event.

Most

investment professionals agree that, although it does not guarantee against

loss, diversification is

the most important component of reaching long-range financial goals while

minimizing risk.”

There are also different types of

diversification e.g Asset class Allocation,

Diversification by Geographical and Sectors etc.

You may find out the 6 types of diversification from Investopedia :

We knew the importance of diversification but

also quite often we hear the other side of the story that diversification may have some

drawback eg, overly diversifying an investment portfolio tends to reduce

potential gains and produce only, at best, average results.

Also, during recent GFC ( Global Financial Crisis), we have seen that regardless of an asset class, most of the asset (equity, bond, commodity, real estate ) being affected and suffered from the tumbling in stock price which makes most of us question the effectiveness of diversification.

Also, during recent GFC ( Global Financial Crisis), we have seen that regardless of an asset class, most of the asset (equity, bond, commodity, real estate ) being affected and suffered from the tumbling in stock price which makes most of us question the effectiveness of diversification.

To Diversify or Not to Diversify?

So what should

novice investors do? Diversify or not diversify? Well, one has to trade off the

loss of the upside with the protection on the downside. You need to ask

yourself which is more important to you.

For most people, the pain from losing

money is felt more deeply than the joy in gaining the same amount on the upside, commonly called "loss

aversion."

If you are like that, then protecting your investment from

the downside risk is a more urgent issue. The more loss-averse you are, the

more you need to build a safety

margin for your portfolio. And diversification

is a powerful tool to build that safety margin.

More about “loss aversion “ from Wikipedia ( here ) :

“In economics and decision theory, loss

aversion refers to people's tendency to prefer avoiding losses to

acquiring equivalent gains: it's better to not lose $5 than to find $5. Some

studies have suggested that losses are twice as powerful, psychologically, as

gains. Loss aversion was first demonstrated by Amos Tversky and Daniel Kahneman.

This leads to risk aversion when

people evaluate an outcome comprising similar gains and losses; since people

prefer avoiding losses to making gains.”…….

Other than “Risk

tolerance “, the diversification strategies will also be determined by your

stage of investment cycles, eg, in the early stage of wealth accumulation, one may

have a more concentrated portfolio but towards retirement age, a more

diversify portfolio may have peace of mind although with less potential of

growth or capital appreciation.

No doubt that

diversification is a good thing but building a diversified portfolio has never

been easier for individual investors.

How about your story of portfolio diversification?

Cheers!

Quote Of The Day :

"Every once in a while, the market does something

so stupid it takes your breath away." - Jim Cramer

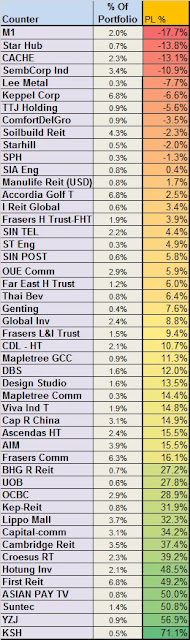

My way of diversification: A “Kiasu “ Equity Portfolio :

You may

notice that I have a diversified portfolio ( latest update here

) with 48 stocks in total, although not in sectors wise where I try

to reduce my exposure in REITs and Business Trust in the last two years, where I

have blogged about it – here

(part 1) and here

(part 2) .

As I

mentioned before, a few multi-bagger stocks in my portfolio may not change the

overall return much since I am allocating less than 10% of my capital in each

counters.

Similarly,

my top 5 worst performance in my portfolio ( with negative return ranging from -7% to -17% ) only constitute about

8.7% of my total portfolio. If any of these company goes “kaput “, it will not have a severe

impact on my overall portfolio value, hence allow me to sleep well.

Detail of my

“Kiasu “ Portfolio as below :

Comments

Post a Comment